▸ THE PROBLEM

The ultimate tool for simplifying financial analysis, making home buying a breeze, and adding excitement to the process.

Myra Super Calculator and Its intuitive interface and user-friendly features are specifically designed to cater to the needs of first-time homebuyers, offering simplified tools and clear guidance throughout the home loan selection process. By demystifying complex financial jargon and presenting information in a straightforward manner, it empowers users with the clarity and confidence they need to navigate the often-daunting journey of purchasing their first home.

Obstacles to address

Financial Constraints

Difficulty in saving for a down payment and covering closing costs.

Affordability

Finding homes within budget in competitive real estate markets

Lack of Knowledge

Understanding the homebuying process, including mortgage options, legal requirements, and hidden costs.

Maintenance Costs

Underestimating ongoing expenses such as property taxes, insurance, and repairs.

▸ RESEARCH SUMMARY

▸ OUR SOLUTION

Simplifying the home loan selection process

Its sophisticated algorithms meticulously analyze various home loan options, taking into account a range of user inputs including income, financial commitments, and other relevant factors. By leveraging advanced computational capabilities, it provides comprehensive insights and recommendations, empowering users to make informed decisions about their home financing options with confidence and clarity.

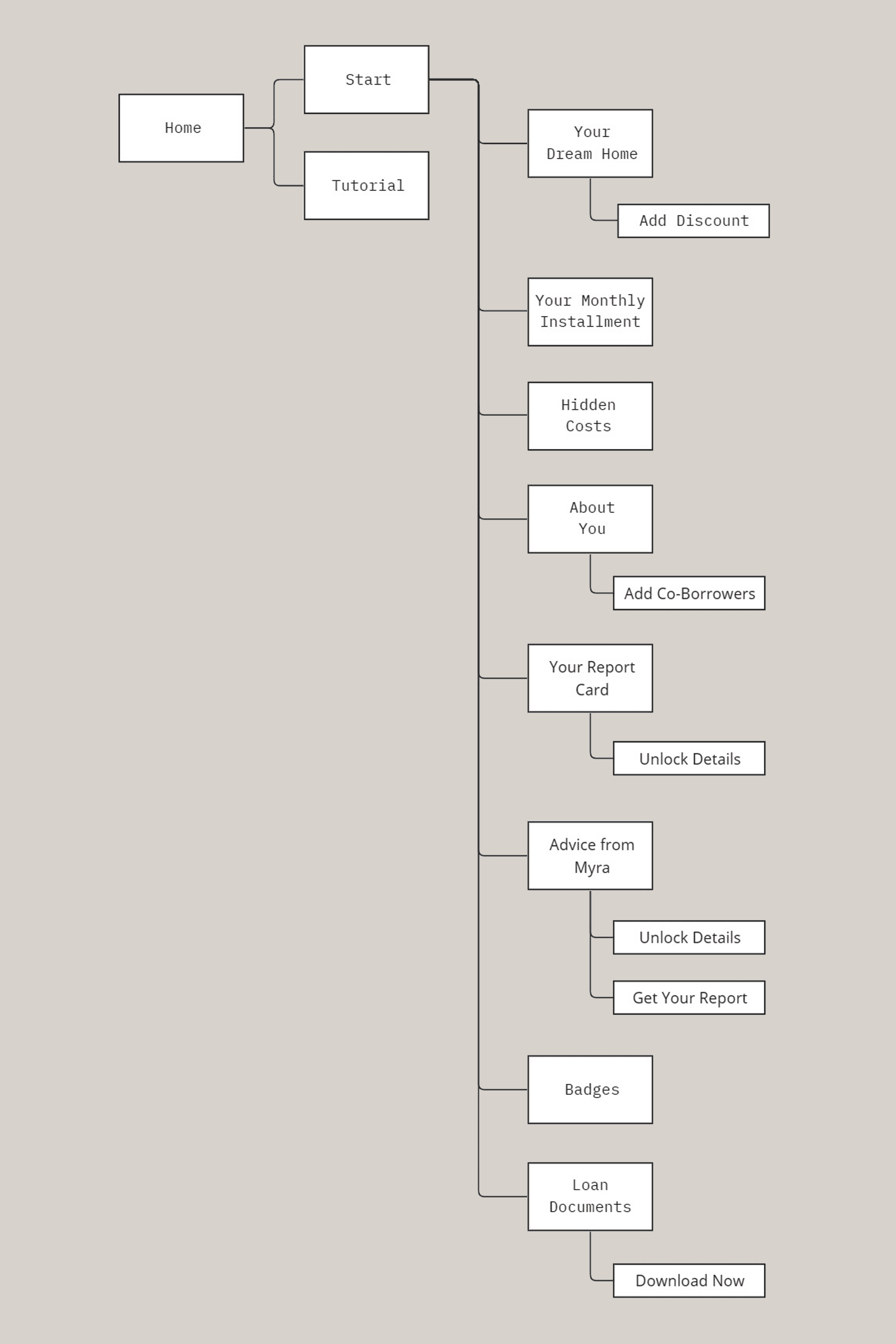

✦ Introduction: The introduction section outlines the purpose and utility of Myra Super Calculator, detailing its functionality, usage, and practical benefits.

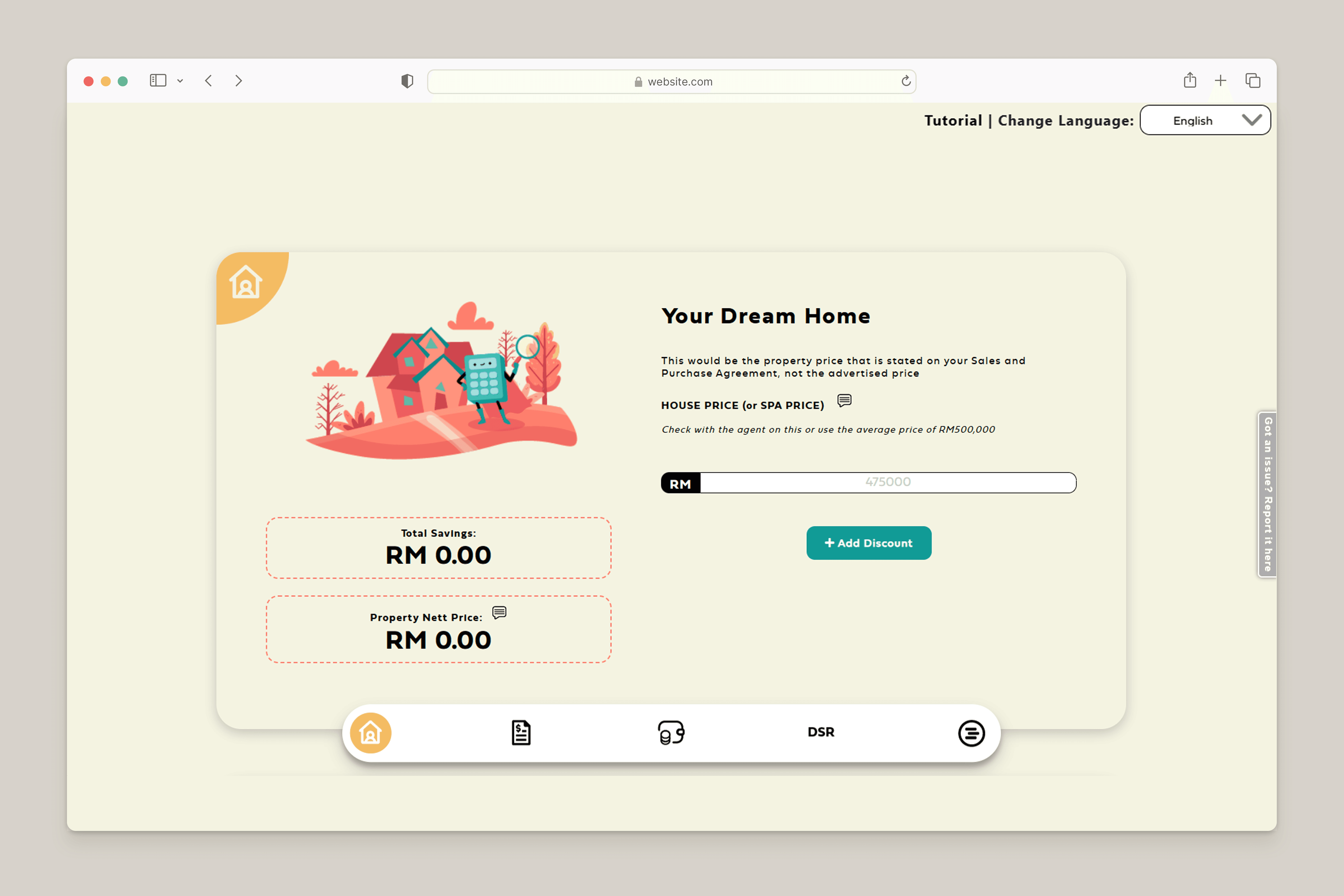

✦ Your Dream Home: This refers to the property price as indicated in the Sales and Purchase Agreement, distinct from the advertised price.

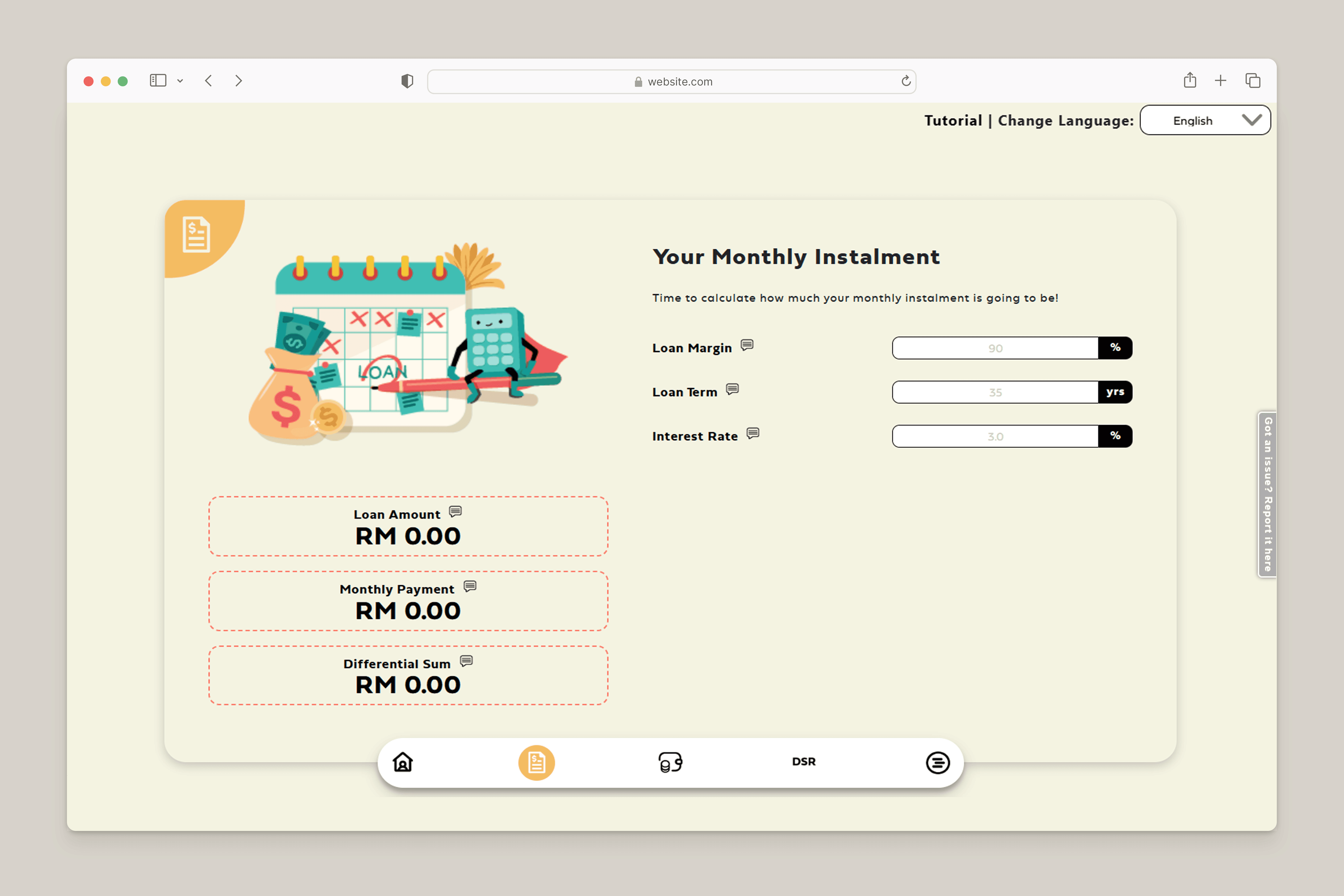

✦ Your Monthly Installment: This is to determine the monthly installment amount.

✦ Hidden Costs: Here is where they should also budget for additional expenses associated with purchasing a house.

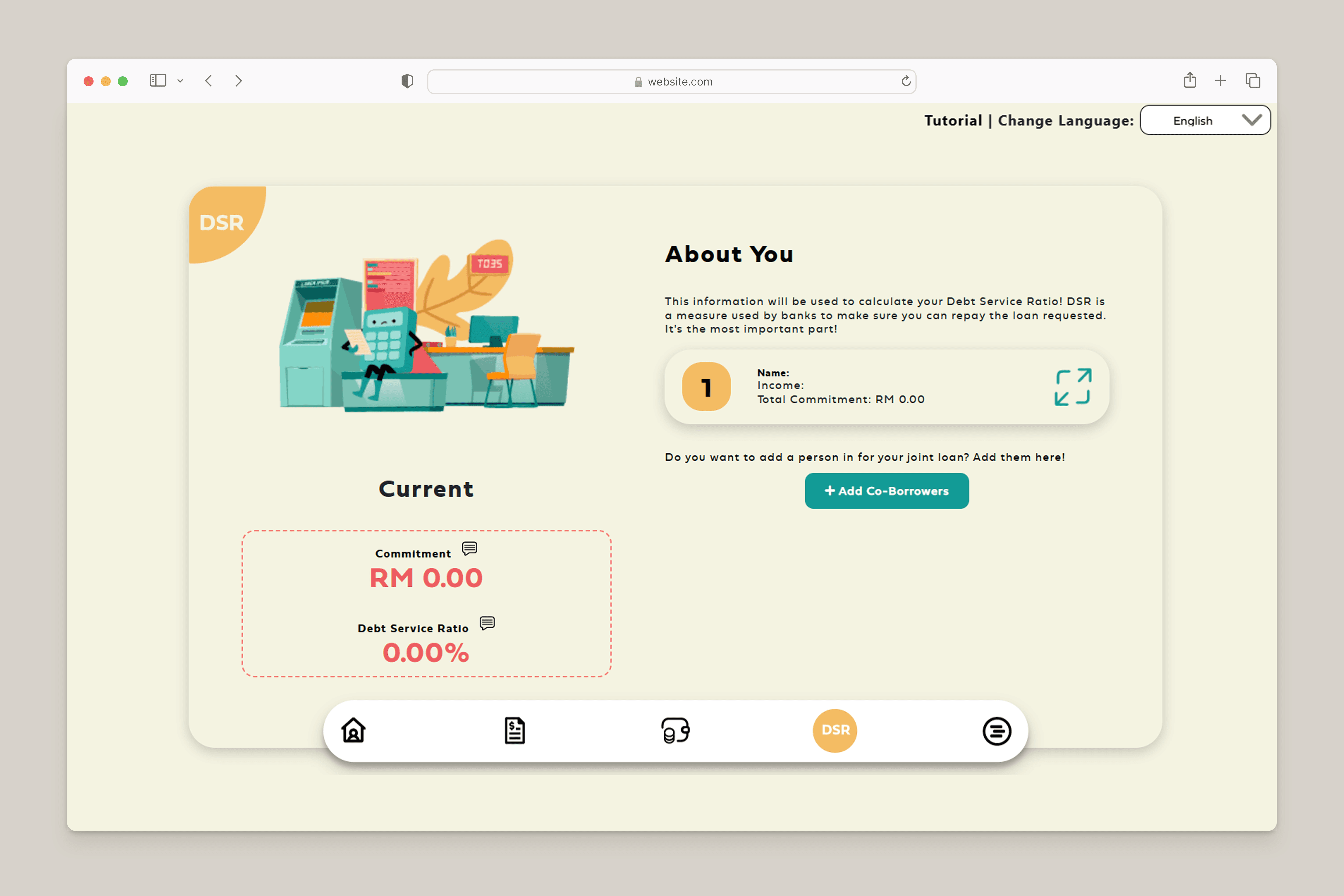

✦ About You: This data will be utilized to determine the person's Debt Service Ratio (DSR), a critical metric banks use to assess your loan repayment capacity, making it a pivotal aspect of the process.

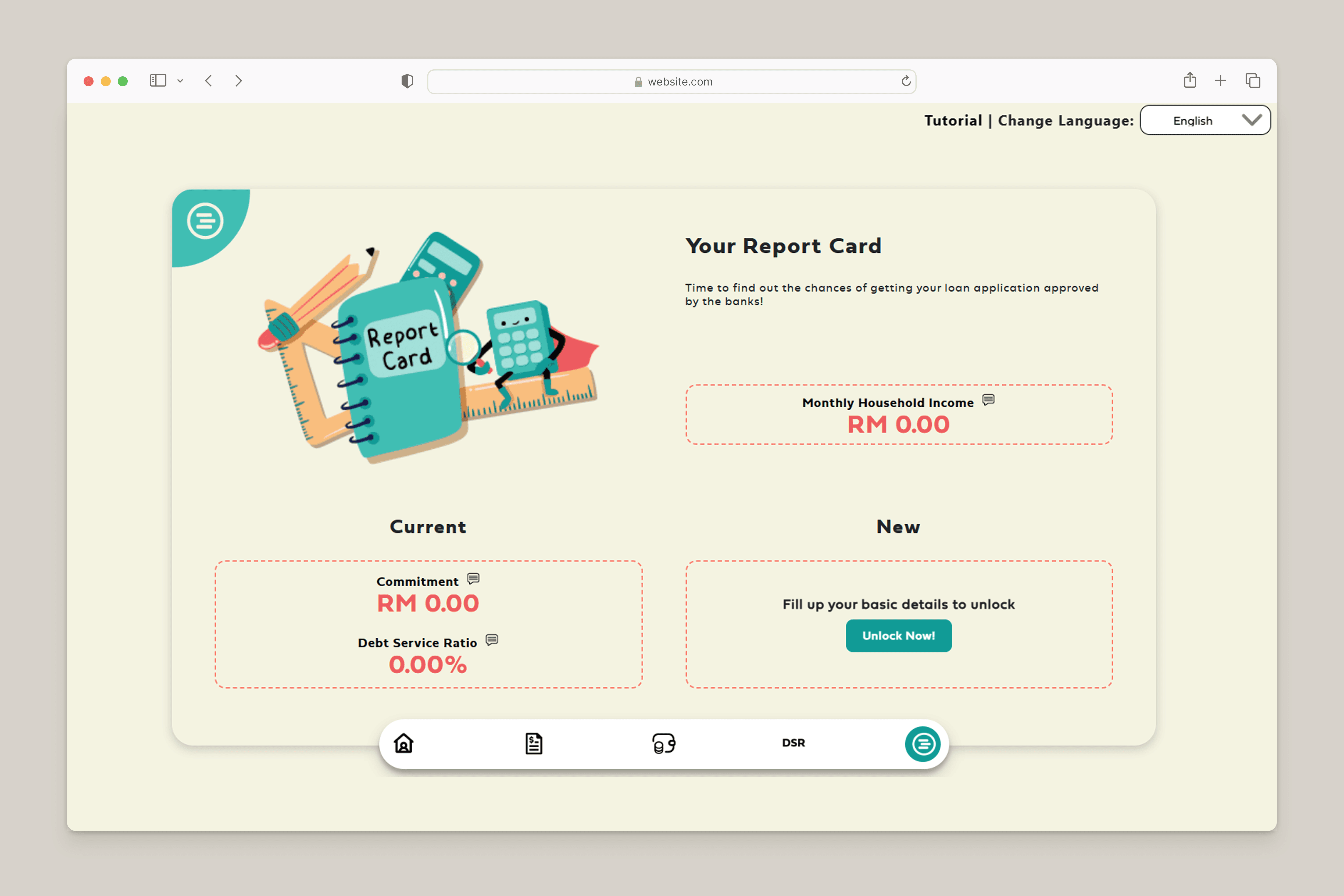

✦ Your Report Card: This section provides insight into the likelihood of loan approval from banks.

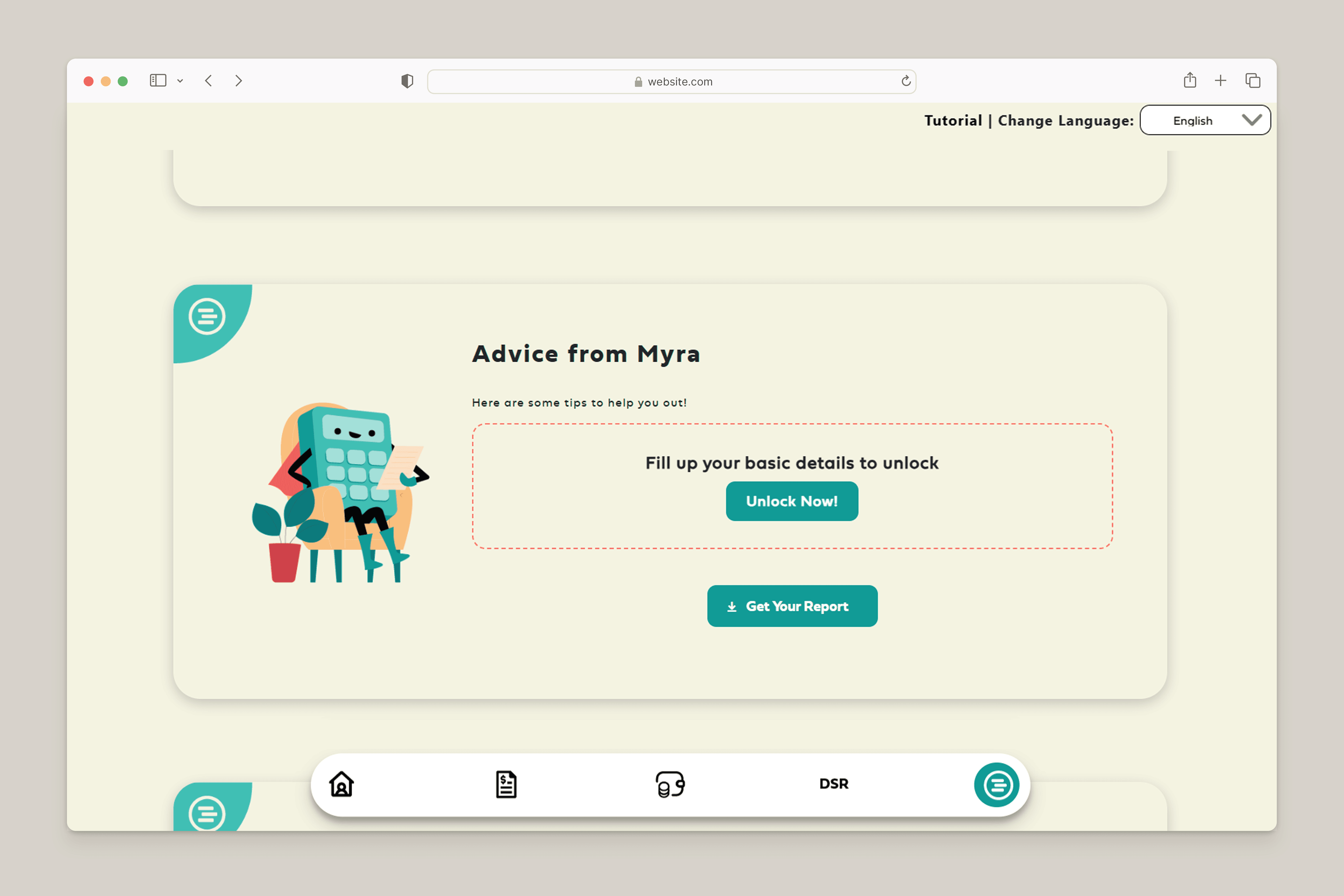

✦ Advice from Myra: Here are some helpful tips from Myra to assist you.

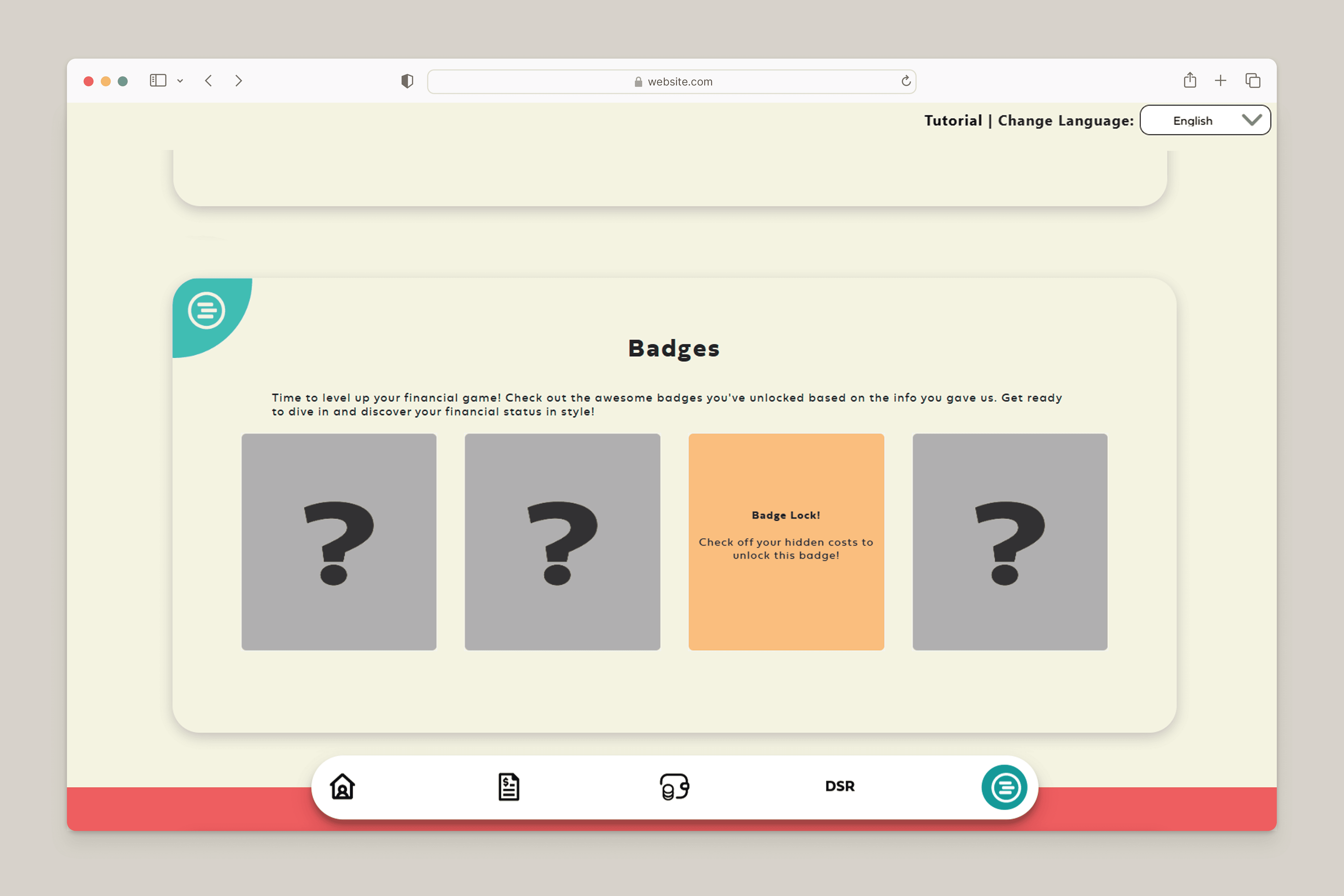

✦ Badges: Users can view the badges they've unlocked based on the information they provided.

✦ Loan Documents: Upon submitting the loan application, banks typically require a comprehensive list of documents. Downloading this will provide the guide and templates.

▸USER PERSONA

▸SITEMAP

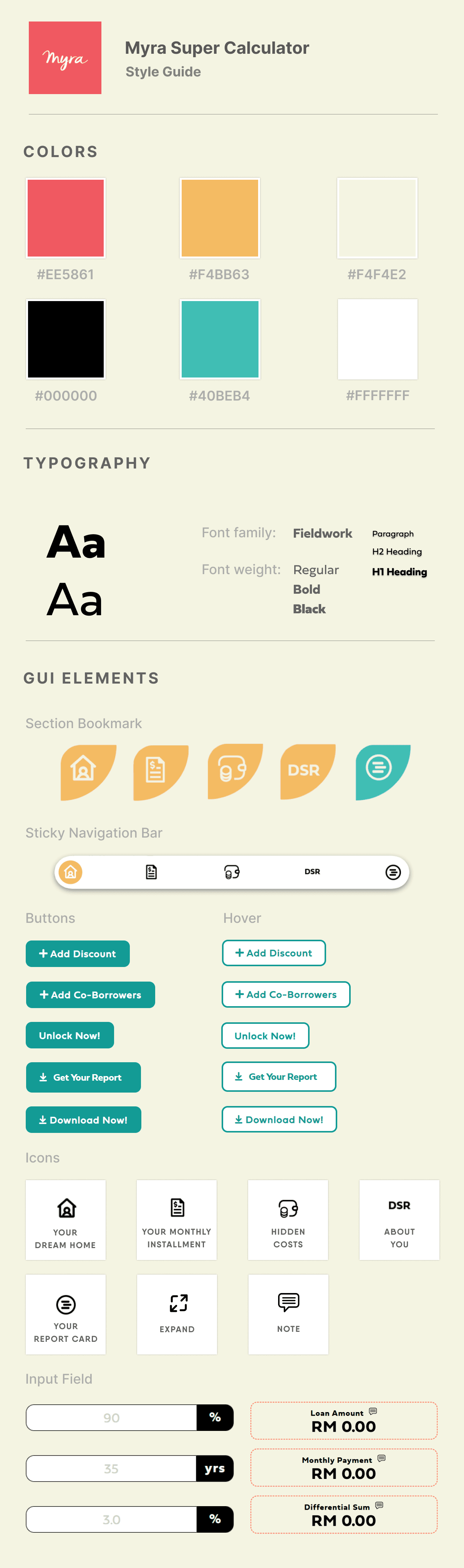

▸DESIGN SYSTEM

▸FINAL OUTCOME

✦ Desktop Version ✦

✦ Mobile Version ✦

© Amira Anisa 2024